July 17, 2017

Critics have described the UAE property market as one driven by hype as opposed to solid fundamentals of supply and demand. In the days when developers would advertise new project launches with offers to Win Your Own Private Island and prospective buyers would cue overnight to secure an expensive piece of air with the plan to on-sell for a premium within 24 hours, few could argue. Those of us who’ve been here for more than 10 years remember these heady days pre-GFC. The days of newly minted cowboy real estate agents & unregulated developers. The days when virtually everyone became a frenzied property punter rushing to big property expos to buy and flip. Buyers rushed in to make a quick buck. And like most get rich quick schemes, many got burnt.

Those days are long gone and thankfully, will never return.

The UAE is only 45 years old. It’s one of the youngest countries in the world. This fact is easily forgotten when you go about your daily life in super modern convenience. Expats who make up reportedly over 85% of the UAE total population, have been able to purchase property in freehold communities for less than 15 years. The UAE property market is still in its infancy compared to other property markets around the world; some of whom have hundreds of years of history and regulation. The UAE freehold property market, to continue the analogy, is virtually a new born.

Today it’s a market driven mostly by end users and to a lesser extent, long term investors. Mortgaged as opposed to cash buyers. Rises and falls in prices are temperate and influenced by fundamentals of supply and demand and sentiment caused by regional & international political and economic events and currency movements.

In a small market heavily reliant upon expats and international investors, ripples abroad can cause waves on local shorelines. We saw that in 2008/2009 and again in 2016 when record low oil prices and regional turmoil exasperated and prolonged a softening of the UAE market which had already been in slow decline since mid 2014. When not so coincidentally is when, the oil price started to fall steeply from $100-$120 per barrel to $26 per barrel in Feb 2016. A 14 year low.

The oil price has stayed above $50 for most of the past 12 months. Still low by historical standards. Dubai with it’s thriving SME sector, is the most diversified GCC economy. And the UAE as a whole is far better diversified than other GCC economies with only 20% of revenues coming directly from fossil fuels. But oil continues to underpin the local and regional economy so a sluggish oil price will directly and indirectly influence the UAE property sector.

$100+ per barrel oil prices are a thing of the past. GCC governments have had to heavily reassess their revenue streams and expenditure. A VAT will be introduced across the regional at the start of next year. This is the new reality.

We hear much about the affordability crisis in Dubai and Abu Dhabi, but the UAE property market is far better diversified than ever. There are definite affordable pockets within Dubai and Abu Dhabi; and property in the Northern Emirates is, by almost any metric, affordable.

The Numbers

Prices have in general, continued to fall in the past 6 months. Both in sales and rentals largely driven by completion of new stock adding to the availability pool in emerging communities.

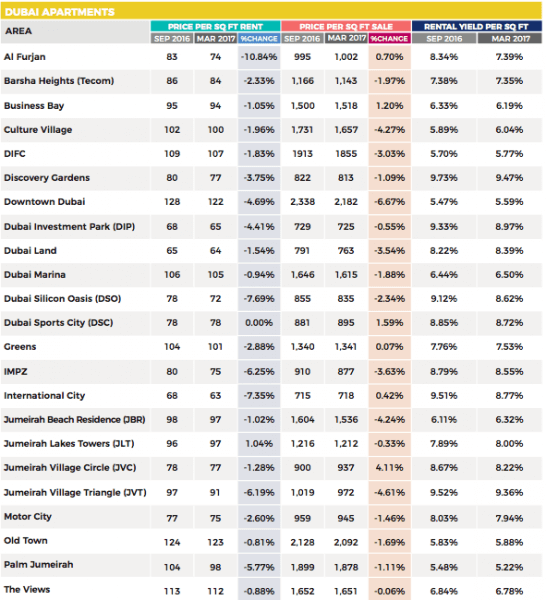

Apartment rents in Al Furjan have dropped a massive 10.8% compared to just 6 months ago due largely to new stock being handed over which means there are some great rental offers currently available. Apartments in DSO (7.7%), International City (-7.4%), IMPZ (-6.3%) & JVT (-6.2%) also fell significantly over the past 6 months.

The declines were not restricted to emerging communities. Palm Jumeirah (-5.8%) & Downtown (-4.7%) also saw significant falls. Downtown with its high concentration of high end serviced apartments, has traditionally been Dubai’s most expensive place to rent an apartment. But with so many big and impressive developments under construction with more to come, it’s subdued low rise neighbour, Old Town is proving more popular with renters. Rents have held steady in Old Town falling just -0.8% in the past 6 months, & with a median advertised price of AED123 per sqft has just become Dubai’s most expensive.

Apartment rents in Dubai Marina (-.9%), JBR (-1%) & Business Bay (-1.1%) were relatively flat. Business Bay was no doubt boosted by the opening of the Dubai Canal. Dubai Marina & JBR rents holding at AED97 per sqft as tenants settle in to watch by the Bluewaters Island Project emerge just off the coastline. Bluewaters is expected to be (partially) operational within 12 months and will add amazing views and lifestyle benefits to Marina & JBR residents. Apartment rents in JLT which increased by 1% were the only in Dubai to buck the downward trend. Traditionally the poor cousin of Dubai Marina life, traffic flow and amenities in JLT have steadily improved over recent years. JLT is home to several parks, many restaurants & interesting small businesses as well as 2 metro stations. And you still get 8% more space for your dirham in JLT compared to Dubai Marina.

In general Dubai apartment prices continued to fall over the past 6 months. The biggest declines were seen in Downtown (-6.7%), JVT (-4.6%), JBR (-4.4%), Culture Village (-4.3%) & JVC (-4.1%). Most other Dubai communities fell modestly or were relatively flat but a few communities including Dubai Sports City (+1.6%), Business Bay (+1.2%), Al Furjan (+0.7%) & International City (+0.4%) actually witnessed increases. In the case of Al Furjan and JVC, completed, affordable, ready to move in apartments were handed over. This is still an undersupplied segment in the Dubai market. International City at AED712 per sqft is still Dubai’s most affordable.

Despite is large steady declines, at AED2,182 per sqft, Downtown is still Dubai’s most expensive, ahead of Old Town at AED2,092 per sqft.

Dubai Apartment Rental Yields.

Dubai continues to be a multi- tiered market where the most desirable locations offer the worst rental yields, while the best yields are found in emerging communities surrounding by desert and mass construction. Discovery Gardens (9.5%), JVT (9.4%) & DIP (9%) continue to offer world leading rental yields. Apartment yields in International City (8.8%), Dubai Sports City (8.7%), IMPZ (8.6%) DSO (8.6%) & Dubai Land (8.4%), JLT (8%) & Motor City (7.9%) continue to be excellent.

Dubai’s lowest apartment rental yields are found in its most desirable locations: Palm Jumeirah (5.2%), Downtown (5.6%) & DIFC (5.8%). Still excellent by international standards, all offer mortgaged buyers positive cash flows.

Here market forces neatly present a neat risk versus reward synopsis. Blue Chip communities for investors are deemed to be safer and despite their popularity have a relatively smaller pool of well heeled tenants who can afford AED120+ per sqft per annum in rent. Emerging communities cater to that large and growing middle income segment seeking affordable rents but for buyers there are many, many projects and apartments complete, under construction and off plan to choose from so these communities tend to be less liquid.

DUBAI APARTMENTS

*Based upon the median advertised price per square foot as published on propertyfinder.ae.

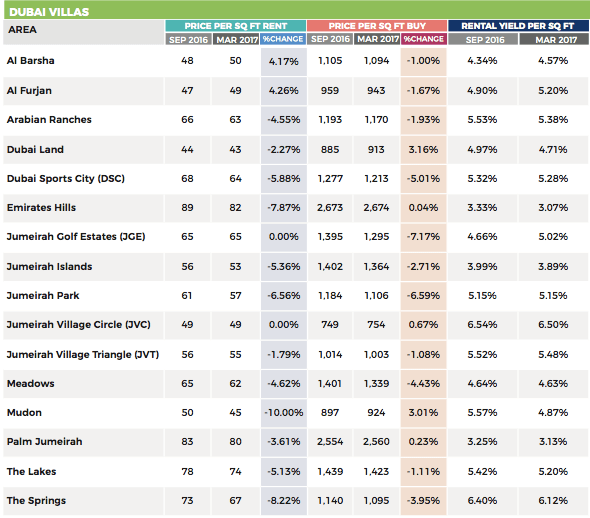

Dubai villas have had a mixed 6 months. We saw significant increases in Al Furjan (+4.3%) and Al Barsha (+4.2%). Villa rents were flat in Jumeirah Golf Estates & JVC. Yet these were the abnormalities. Most communities saw declines a direct result from a continued sluggish oil price and regional economy. Mudon by DP witnessed the biggest decline with rents dropping a big 10% in the past 6 months driven largely by the completion and handover of 400 homes in Phase 2 of the development in October 2016. But any large scale handover will have a short term impact on rents and owners compete with one and another for limited tenants. The next largest decline came in The Springs (-8.2%), Emirates Hills (-7.9%), Jumeirah Park (-6.6%), Dubai Sports City (5.9%) & Jumeirah Islands (-5.4%). While the decline in Emirates Hills’ & Jumeirah Islands can be largely attributed to regional economic stagnation which in the UAE often hits the very top of the market hardest, other communities in this list are all direct competitors of Al Furjan, where a high volume of large affordable villas came online in Q1 2017.

Affordable villas continue to be hot property in Dubai and two affordable villa communities Mudon (+3%) and Dubai Land (+3.2%) saw price rises in the past 6 months. While prices in Jumeirah Golf Estates (-7.2%), Jumeirah Park (-6.6%), Dubai Sports City (-5%) and the Meadows (-4.4%) saw notable declines. By comparison all are higher ticket items, these communities suffered from in increased external competition & in the case of Jumeriah Golf Estates, internal new releases. Emirates Hills and Palm Jumeirah continue to demand prices above AED2,500 per sqft and remain Dubai’s most expensive. While JVC asks just AED754 per sq ft & remains Dubai’s most affordable villa community.

Dubai Villa Rental Yields

For investors Dubai villas can offer interesting options. Like their apartment counterparts the best villa rental yields can be found in affordable (mostly) emerging communities like JVC (6.5%), JVT (5.5%) & Al Furjan (5.2%). Some of the more established popular villa communities also offer decent yields such as The Springs (6.1%), Arabian Ranches (5.4%), Dubai Sports City (5.3%) and The Lakes (5.2%). Again if the villa community is relatively affordable the rental yield is healthy but they steadily decline as you move up the food chain. Emirates Hills and Palm Jumeirah both offer ~3.1% yields which in virtually any other market in the world is acceptable, but in Dubai appear sluggish.

DUBAI VILLAS

*Based upon the median advertised price per square foot as published on propertyfinder.ae.

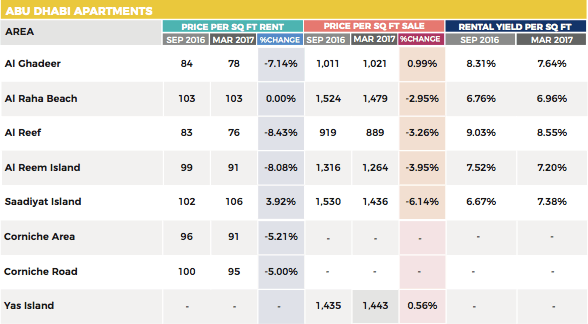

Rents continue to decline in Abu Dhabi where a reduction in government spending in direct correlation to sluggish oil prices has reduced employment and demand for housing in the capital. Abu Dhabi’s most popular Abu Dhabi communities including Al Reef, (-8.4%) Al Reem Island (-8.1%), Al Ghadeer (-7.1%) and Corniche Area (-5.2%) all saw significant declines. Al Raha Beach remained flat while Saadiyat Island bucked the trend with a 3.9% increase. Apartments in Saadiyat Island are Abu Dhabi’s most expensive asking 106 per sqft per annum.

Saadiyat Island apartments saw a 6.1% decline and are now no longer Abu Dhabi’s most expensive to buy. Prices held better in Al Raha Beach despite a decline of almost 3%. Al Reem Island (-4%) and Al Reef (-3.3%) also saw similar declines while apartments in Al Ghadeer & Yas Island actually saw small increases. Al Ghadeer sits on the Dubai border and although technically in Abu Dhabi is closer to Dubai commercial & lifestyle centers than to those in Abu Dhabi. While prices in Yas Island may have received a boost with the announcement of AED12Billion to be invested in developing the promenade and surrounding areas; the relocation of the Abu Dhabi Media Free Zone Authority TwoFour54 & the world’s first Mercedes Benz AMG showroom.

Abu Dhabi Apartment Rental Yields

Al Reef (8.6%) offers the best yield in Abu Dhabi while apartments in Abu Dhabi’s other popular communities all achieved close to and over 7%.

ABU DHABI APARTMENTS

*Based upon the median advertised price per square foot as published on propertyfinder.ae.

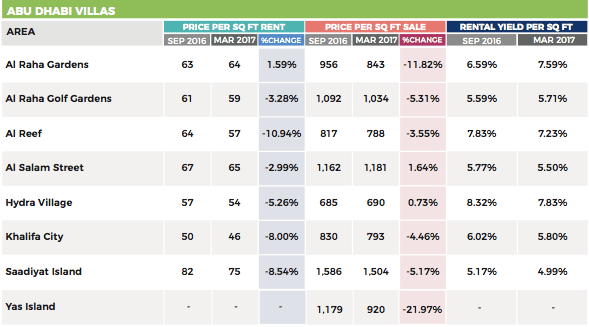

Villa rents in Abu Dhabi continue to fall across all segments of the market from the most affordable communities; Al Reef (-10.9%) & Hydra Village (-5.3%) to the mid range; Khalifa City (-8%) & al Salam Street (-3%) to the very top end; Saadiyat Island (-8.5%). Al Raha Gardens was the only community where villa rents increased (+1.6%)

As with rents, Abu Dhabi villa sale prices in general have continued to fall at a steady pace with Al Raha Gardens (-11.8%) seeing the biggest decline. Falls were more modest in Al Raha Golf Gardens (-5.3%), Saadiyat Island (-5.2%) & Khalifa City (-4.5%) yet still significant. Villa prices in Al Salam Street and Hydra Village witness very small increases.

Abu Dhabi Villa Yields

Al Hydra Village offers the best rental yields in Abu Dhabi with 7.8% just ahead of Al Raha Gardens but both are down compared to 6 months ago. All popular Abu Dhabi villa communities continue to offer investors 5%+.

ABU DHABI VILLAS

*Based upon the median advertised price per square foot as published on propertyfinder.ae.

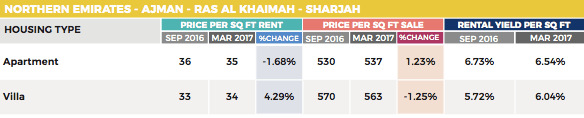

The Northern Emirates

Prices have been more stable in the Northern Emirates. Always the cost effective option for budget conscious renters and buyers, many of whom commute to and from Dubai each day. Prices moved up and down in the very low single digits across the Northern Emirates in both sale and rent over the past 6 months.

For investors the rental yield in Sharjah & Ajman in particular looks particularly enticing. We’ve seen some launches of free-zone off plan projects recently in Sharjah which is now competing with Dubai & RAK for non GCC buyers.

NORTHERN EMIRATES

*Based upon the median advertised price per square foot as published on propertyfinder.ae.

This article was written by Lukman Hajje CCO Propertyfinder Group and appeared in Propertyfinder Trends (July 2017).

View the full publication online here.

Calculate your mortgage repayments here.

Click here to your perfect UAE property on propertyfinder.ae

Click here to talk to us about your commercial finance needs.