Paying interest on a loan of money is forbidden under Shariah law, so many lenders offer Islamic mortgages that comply with Shariah law, as well as ‘conventional’ mortgages.

What is a conventional mortgage?

With a conventional mortgage, a financial institution such as a bank will lend money to purchase a new home and they will charge interest on this loan.

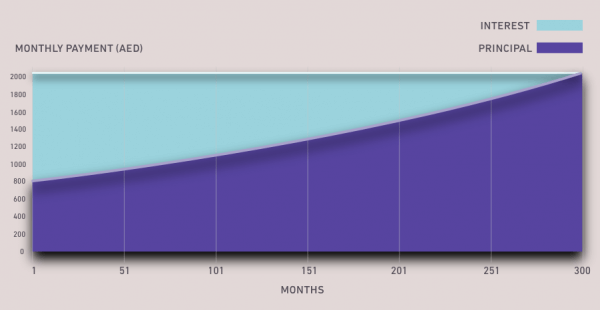

A conventional mortgage is made up of the principal (the amount borrowed) and also the interest charged on the loan. With most mortgages, the principal and interest are paid off monthly over 25 years, which is why they are also known as repayment mortgages.

In the early years, most of a borrower’s payments are set against paying off the interest with a smaller part reducing the principal. As the end of the term nears, this switches so that more is paid off from the original loan each month.

An example of principle and interest payments over the term of a mortgage

What is an Islamic mortgage?

An Islamic home loan works differently because Islamic financial institutions are forbidden from charging interest. There are several Islamic financing models, Murabah and Ijarah being two key models used for home loans.

Murabaha financing

With Murabaha financing, the bank purchases a property on behalf of the customer and ‘re-sells’ it to them at a profit. The buyer then pays the bank back through monthly instalments.

Islamic banks need collateral to protect against the buyer not making their repayments, so the property is registered to the bank until all mortgage payments are complete, although there are some banks that will include the tenant’s name on the title deed.

An advantage of a Shariah-compliant home loan is that there are no additional interest payments for late payments (though the bank may charge a fixed fee).

Ijarah financing

Another Islamic financing model applied is Ijarah, which a buy and lease-back arrangement. This model is useful if you are buying a property off plan as no payments are made until the property is completed.

As an example, here’s a simple calculation with an Islamic mortgage using Ijarah

Let’s assume that you are purchasing a property worth AED 1,000,000 and you make a down payment of 200,000 with a loan of 800,000 to be repaid over 4 equal annual instalments. You would currently own 20% and thereafter, your repayment schedule would look like this:

| Year | Loan Repayment | Outstanding Amount | Percentage of Ownership (Bank) | Percentage of Ownership (You) |

| 1 | 200,000 | 600,000 | 60% | 40% |

| 2 | 200,000 | 400,000 | 40% | 60% |

| 3 | 200,000 | 200,00 | 20% | 80% |

| 4 | 200,000 | 0 | 0 | 100% |

So essentially, over the years you are buying a larger portion of ownership of the house, similar to the principle on a conventional mortgage. As a ‘co-owner’ of the house the bank charges you ‘rent’. However, as you buy out the bank’s share of ownership the rent liability decreases over time. Assume that the rent is 200,000 per annum, you would pay as follows:

| Year | Rental Amount |

| 1 | 200,000 x 80% (bank’s ownership % during the year) = 160,000 |

| 2 | 200,000 x 60% = 120,000 |

| 3 | 200,000 x 40% = 80,000 |

| 4 | 200,000 x 20% = 40,000 |

| 5 | The property belongs to you 100% – no need to pay rent. |

By Ian Vaughan CeMap, Senior Mortgage Advisor at mortgagefinder.ae