Plans are underway to launch the online Real Estate Self Transaction (REST) system, meaning local mortgage lenders are going to have to modernise – fast.

When is the last time you wrote a cheque? In many parts of the world the answer is likely to be some time last century. But here in Dubai it could have been just last month – to pay your rent. Most banking processes in the UAE were formulated decades ago, and despite the introduction and widespread usage of internet banking and banking apps, the paperwork, policies and procedures that underpin them remain there.

Opening a bank account or acquiring a mortgage in the UAE can at times require monk-like patience. This week, Will Rankin, a well-known business journalist based in Dubai, urged his readers to abandon cheques. “I’m not getting another cheque book,” he wrote. “Let’s all refuse cheque books and force the UAE’s banking system to accept modern, normal payment systems.”

Rankin’s rant is perhaps misplaced. The popularity of cheques in the UAE is not a failure of the banking system (which does offer alternative payment methods) but a safety measure in a country with a lengthy legal process and a highly transient populace.

Cheques hold more weight than legal contracts. They are contracts for the people, if you prefer. Is it the best system? No. But right now it’s the best we’ve got.

In line with this, anyone who’s been through the mortgage process here in the UAE knows that prior to disbursement you are presented with and forced to sign an undated cheque for the entire borrowed amount, plus interest.

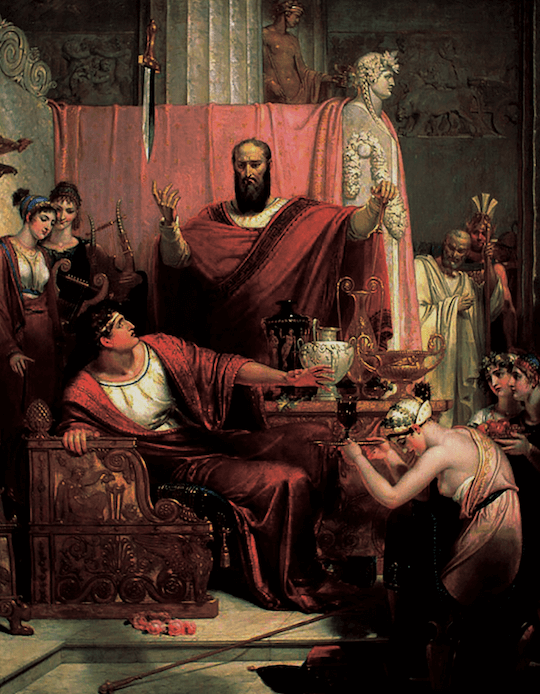

No doubt the biggest cheque you’ll ever sign; a sword of Damocles-esque security measure for the bank. Should you stop making payments and become non-responsive, they’ll bank the cheque knowing full well it will bounce. With a bounced cheque in hand, they can start legal action.

No doubt Rankin is on to something; the UAE banking system needs to be overhauled and the Dubai government agrees. The Dubai Land Department (DLD) recently announced plans to launch Real Estate Self Transaction (REST), an online platform to conduct real estate trading and transactions including end-to-end online mortgage applications and disbursement.

According to DLD, REST will simplify existing legacy-laden processes, and aims to facilitate the digitisation of real estate transactions and mortgages by Q1 2020. Any initiative that promotes transparency and eases the process for consumers should be applauded, but a Q1 2020 timeline is perhaps ambitious.

Having personally gone through a mortgage refinance recently, I can attest to the many patience draining legacies that exist in the UAE mortgage process that will need to be completely rethought and re-engineered.

Propertyfinder Group owns the UAE’s leading mortgage brokerage, mortgagefinder.ae, so thankfully most of the headache was handled by them. But even with the very best in the business at my full disposal, a number of tasks required my direct, physical presence:

- A banking representative had to physically view my signing of the mortgage application form and my original ID documents

- I had to physically go to the bank (where my salary is deposited each month) to request and collect stamped paper copies of my bank statements to verify my income. Printed online statements and a stamped salary certificate from my employer were not sufficient. There is no system in place for the banks to digitally communicate with each other to confirm salary deposits, as I’m employed in a freezone my salary is not registered by any government authority

- My existing lender requested that I come into one of their branches in person to collect a “liability letter”; a single page document that states the amount owed on my mortgage

- Prior to disbursement, I had to again go into the bank of my new lender, to sign two single page forms: a Service Request Form to “request full or partial settlement of mortgage loan” and an authorisation to hand over settlement documents

There were literally dozens of additional forms and offline procedures that had to be completed in the process, which the mortgagefinder.ae team handled for me.

Some processes are pure legacy, unnecessary and could easily be digitised. Others were stalling tactics by my former lender to extract a few extra dirhams in interest. But the rest are there for a reason; specifically to protect the bank against fraud which could be perpetrated by the borrower, the broker, or even a bank employee.

The US subprime mortgage crisis highlighted the dangers of such practices ten years ago. But the risks still exist, even in highly regulated markets like Australia, where a government investigation just this year uncovered widespread forgery of documents, ID fraud, and best interest negligence in their mortgage and financial services sector. Many of these offences were committed by commission-hungry bank employees from top to bottom.

If UAE banks are to fully digitise their mortgage application process in line with the DLD REST initiative, they’ll need to vastly overhaul their policies, technology and mindset without jeopardising safe lending practices.

Mortgaged buyers accounted for roughly 70 per cent of secondary market transactions in 2017, or US $37.7 billion in value, according to the DLD. This is a sizeable market. And to the victor of disruption will go the spoils.

Trussle, a London-based online mortgage broker owned by Zoopla (recently sold to a US private equity firm for nearly $3 billion), aims to be the digital alternative to the offline mortgage search and application experience.

Zoopla invested in Trussle in 2016; at the time a million mortgages were disbursing per annum, 75 per cent intermediated through brokers, mostly offline. Paul Whitehead, the Chief Strategy Officer at Zoopla, says the benefit of Trussle for banks and consumers is a “faster time to yes”; shortening the mortgage application process to a matter of days, rather than months.

Lendi.com.au, based in Sydney, Australia, is another online mortgage brokerage hoping to disrupt this space. Co-founder and Managing Director David Hyman says it wasn’t hard to get banks signed onto Lendi because it solves many pain points by bringing processes online. Hyman admits it is a “tech-first but not tech-only” model. Lendi’s aim is to allow customers to do as much as possible online, they then get assigned to a home loan specialist who is there to finalise the mortgage.

The Trussle and Lendi models are possibly what the UAE government hopes to achieve by Q1 2020. But even in the world’s most advanced markets, the endto-end online mortgage experience is not quite there yet and at this stage represents a small percentage of the market.

No doubt in time this will change, but will UAE banks get there by Q1 2020?