Understanding Islamic Mortgages and Home Loans in the UAE

Islamic finance plays an important role in the UAE’s property market, offering homebuyers Sharia-compliant options that avoid interest-based lending. If you’re looking to purchase a home while following Islamic principles, an Islamic mortgage or Islamic home loan can be a suitable choice.

This guide explains what these products are, how they differ from conventional mortgages, and what to expect when applying in the UAE.

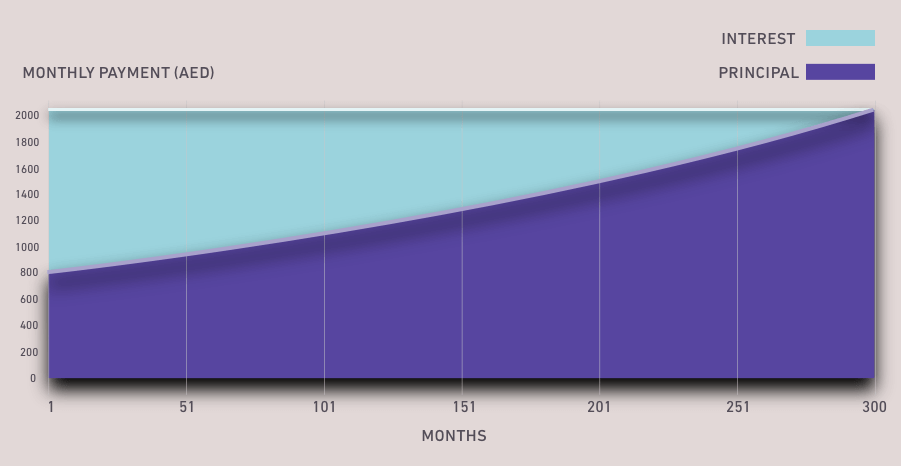

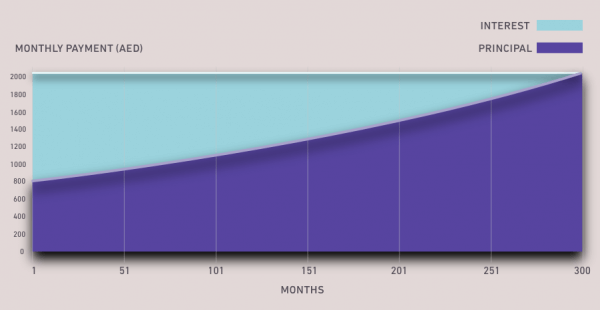

An example of principle and interest payments over the term of a mortgage

What Is an Islamic Mortgage?

An Islamic mortgage is a home financing arrangement that complies with Sharia principles, meaning it does not involve interest (riba). Instead of lending money and charging interest, the bank purchases the property on your behalf and allows you to buy it back over time through a series of agreed instalments.

This structure is designed to ensure that transactions are based on asset ownership and risk-sharing, aligning with Islamic values.

Key Principles of Islamic Home Loans

When applying for an Islamic home loan, you can expect these core principles:

-

•No Interest (Riba): The agreement avoids charging interest on the borrowed amount.

-

•Asset-Backed Financing: The property serves as the underlying asset, ensuring real value exchange.

-

•Risk Sharing: Both the bank and the buyer share certain risks of ownership.

-

•Ethical Investment: Funds are not invested in industries that conflict with Islamic values.

Main Types of Islamic Mortgage Structures

In the UAE, Islamic mortgages typically use one of the following structures:

Ijara (Lease-to-Own)

The bank purchases the property and leases it to you. You make monthly rental payments, and once the term ends, ownership is transferred to you.

Murabaha (Cost-Plus Financing)

The bank buys the property at market value, then sells it to you at an agreed markup. You repay the cost in fixed installments over a set period.

Diminishing Musharaka (Partnership)

You and the bank jointly purchase the property, with your share increasing as you make repayments until you become the sole owner.

How Islamic Home Loans Differ from Conventional Mortgages

While conventional mortgages involve borrowing money and repaying it with interest, Islamic home loans are structured around trade, leasing, or partnership agreements. This means:

-

-Payments are linked to the use or purchase of the property, not interest charges.

-

-Profit margins are agreed upfront, providing more predictability.

-

-The financing process adheres to Islamic banking regulations and Sharia boards.

Eligibility and Application Process in the UAE

Applying for an Islamic mortgage in the UAE involves similar steps to a conventional mortgage, but with additional Sharia compliance checks. Typical requirements include:

-

-Proof of income and employment

-

-Valid residency visa or UAE nationality

-

-Minimum deposit (usually 20% for expatriates, 15% for UAE nationals)

-

-Credit history review

Once approved, your agreement will be overseen by the bank’s Sharia board to ensure compliance.

Benefits of Choosing an Islamic Home Loan

Opting for an Islamic home loan can offer:

-

•Sharia-compliant financing that avoids interest

-

•Transparent and predictable payment terms

-

•Ethical banking aligned with Islamic values

-

•Access to competitive rates and flexible repayment options in the UAE

For homebuyers in the UAE seeking Sharia-compliant financing, an Islamic mortgage or Islamic home loan provides a practical and ethical way to purchase property. By understanding the different structures and benefits, you can choose the right financing option that aligns with your values and financial goals.

By Ian Vaughan CeMap, Senior Mortgage Advisor at mortgagefinder.ae